Optionistics is not a registered investment advisor orīroker-dealer.

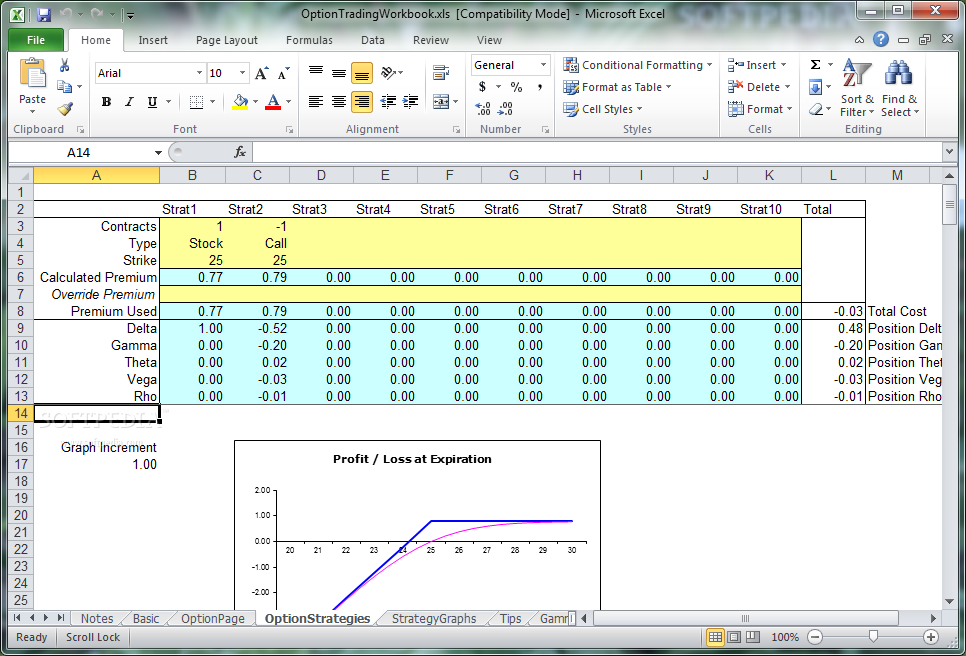

Stock exchange symbols preferred stock dividends best yielding stocks risk trading dividend yielding stocks volatility skew historic stock price write covered calls historical stock prices historical stock value put call ratio indicator quotes stock what are stock options basics double diagonal leverage futures leverage futures covered calls learn stock trading option calculator option trading basics of stocks stock option probability calculator Having Trouble? Use the old Options Calculatorĭata Provided by This increase in volume leads back to paying higher fees and increasing the risk of experiencing a magnified loss.BABA Stock Options chart. Using our stock return calculator is really simple. Instruments that are traded in US Dollars (such as USD currency pairs, commodities, cryptoassets and stocks traded on US exchanges) do not require a conversion. Temptation: Amplified returns are very tempting, but they can also lead to overtrading. Stockchoker, our stock profit calculator, lets you easily figure out what a past investment would be.Does it throw you off the plan? If the answer is yes, you might consider limiting or altogether avoiding the leverage. It is not about suffering a single significant loss it is about what you do after experiencing such a loss. There is simply too much unpredictability on the market, and losses (when leveraged) can be devastating. Magnified losses: There is no trading strategy out there that avoids losses.If you use high leverage on a small account, the fees will quickly add up to a considerable amount. Higher fees: The fees that you pay will be proportional to the size of your position.There are also several potential drawbacks of leverage. You can simply trade at a smaller size and follow your risk management plan. Having a low margin requirement allows you to use high leverage, but you don’t have to. Meanwhile, a 2:1 leverage equals a 50% margin, while a 10:1 leverage equals a 10% margin. There are two sections in the app, the first section is to calculate.

#Stock profit calculator simple full size#

You need to have a full size of the position in cash. Stock Profit Calculator is a simple, handy, good looking tool to use while trading. For example, unleveraged (cash) accounts equal a margin of 100%. The difference is that you express leverage as a ratio and margin as a percentage. While it can be slightly confusing to those new to finance, leverage and margin are both cut from the same cloth. In contrast, others like financials might have a much higher average due to the business structure. While anything under 2 is considered a good ratio, some sectors like technology will have less leverage. If you're investing in equities, the D/E ratio will be a part of your research process, but do keep in mind that there is no one-size-fits-all approach. Where shareholder equity equals total assets minus total liabilities. You can calculate it by dividing a company's total liabilities by its shareholder equity. Leveraged Portfolio Return = Return on Investments + ĭebt/Equity (D/E) is an important financial ratio that measures a company's financial leverage. Yet, if you are constructing a leveraged portfolio, your primary concern will be the cost of debt.įor calculating returns, consider the following formula: Each option contract gives you access to 100 shares. All fields are required except for the stock symbol. Options profit calculator will calculate how much you make and the total ROI with your option positions. If you are a short-term speculator, your leverage cost will come in the form of high fees. Options Calculator is used to calculate options profit or losses for your trades. This scenario requires risk evaluation and management skills. For example, if you're already fully-invested (unleveraged) but identify a low-risk opportunity, you can use the margin.

Just like a bank will charge you an interest rate for a loan, the broker will charge you fees for using leverage. You are using debt every time you use leverage, with your balance serving as collateral. In practical terms, leverage is the use of borrowed funds to increase position beyond your account balance.

0 kommentar(er)

0 kommentar(er)